Religious or apostolic organizations exempt from income tax under section 501(d) must report their taxable income, which must be allocated to their members as a dividend, whether distributed or not.

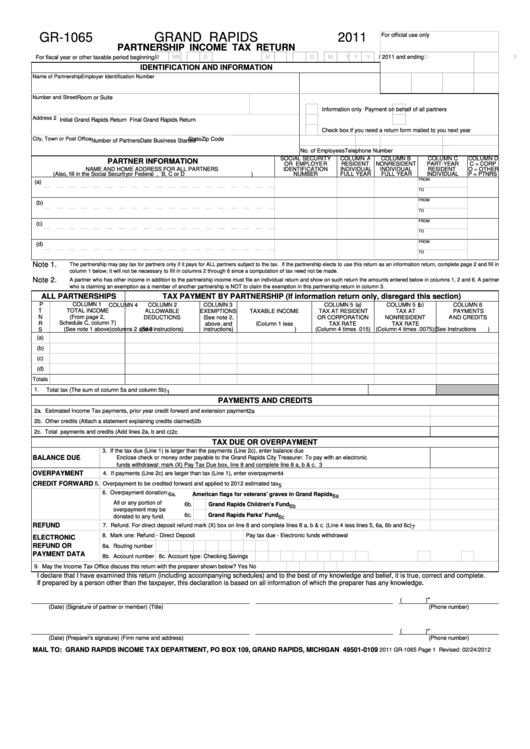

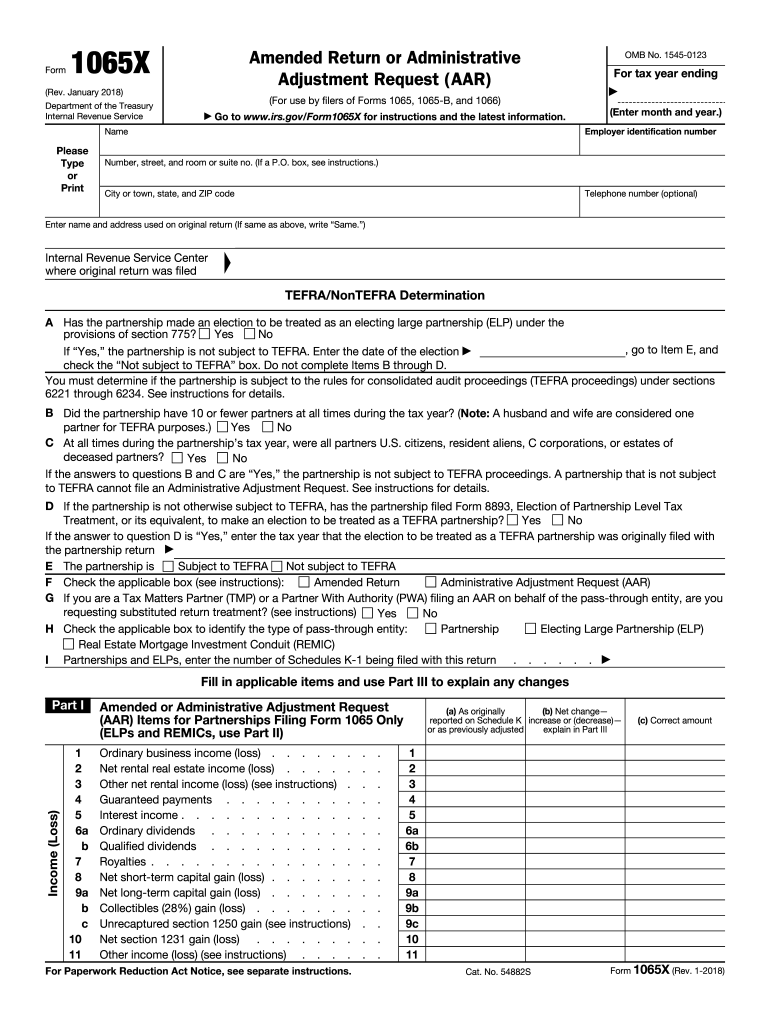

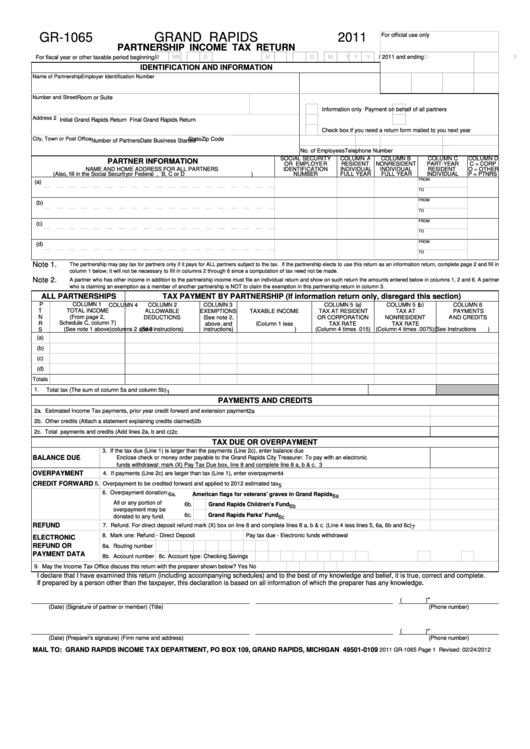

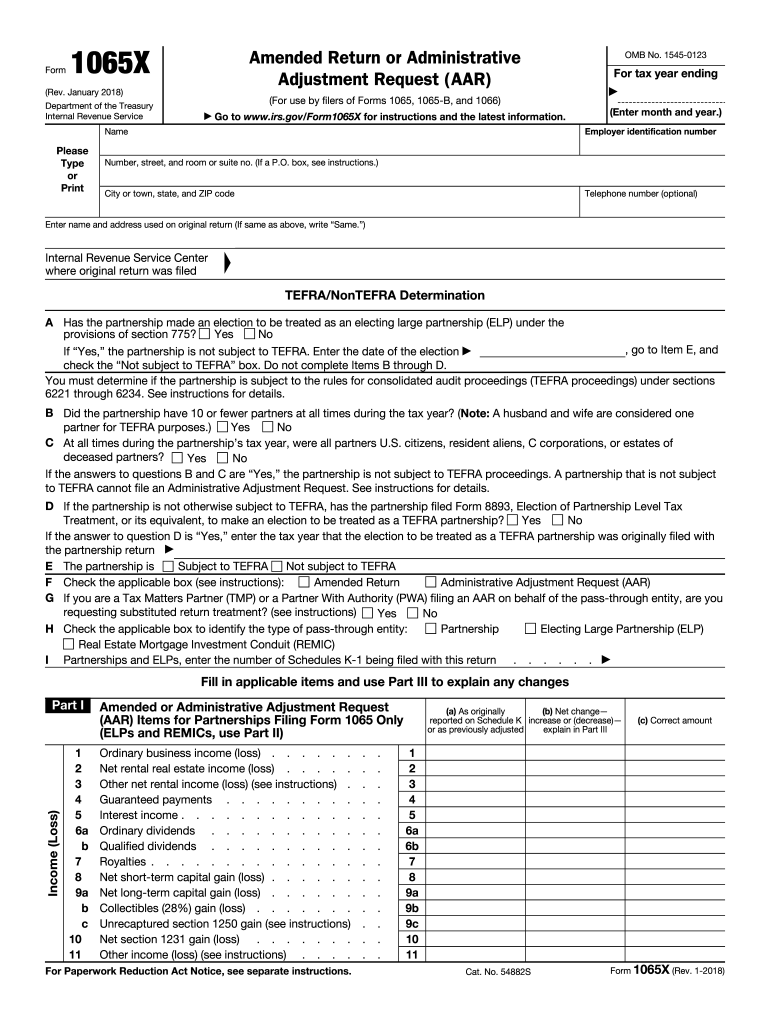

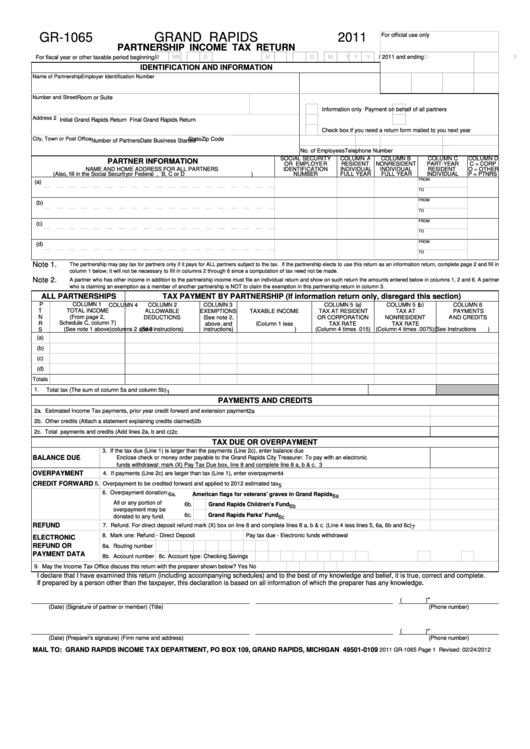

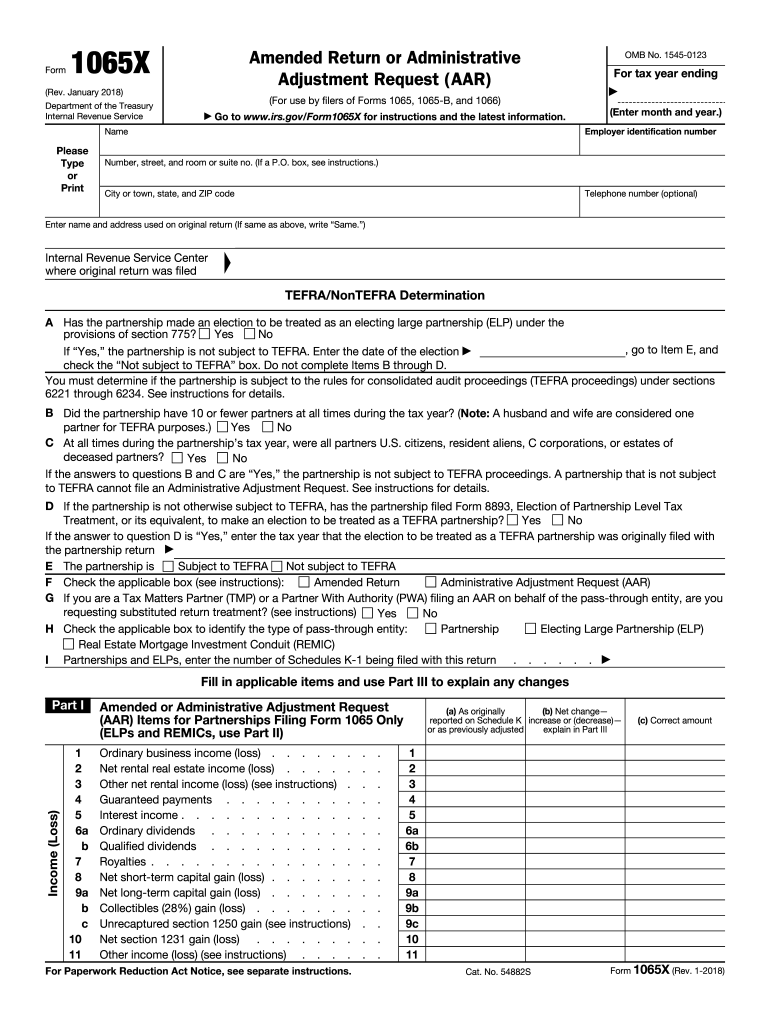

LLCs that are classified for income tax purposes as a partnership. Foreign partnerships that have gross income effectively connected with the conduct of a trade or business within the United States. All domestic partnerships, except for the cases listed below. Each partner must include Form 1065 when they file their income tax return. Instead, the profits or losses are “passed through” to the partners, who pay tax on it through their individual income tax returns. The partnership itself does not pay tax on its income. Return of Partnership Income.” This is an information return for partnerships to report the income, gains, losses, deductions, credits, etc.

LLCs that are classified for income tax purposes as a partnership. Foreign partnerships that have gross income effectively connected with the conduct of a trade or business within the United States. All domestic partnerships, except for the cases listed below. Each partner must include Form 1065 when they file their income tax return. Instead, the profits or losses are “passed through” to the partners, who pay tax on it through their individual income tax returns. The partnership itself does not pay tax on its income. Return of Partnership Income.” This is an information return for partnerships to report the income, gains, losses, deductions, credits, etc.